Happy Hour Presentation

Overview

+ Quick Background on Blake

+ Covid-19 Effects on Real Estate Transactions

+ Innovations in Real Estate

+ Blake’s Insights on the State of the Market

+ FAQ’s

+ Who you can Refer to me

Who is Blake Sherwood?

Covid 19 Effects on Real Estate Transactions

Working with Sellers

Extended listing preparation

exposure concerns of venders

precautions that need to be taken

delays due to supply chain issues especially in new construction

permit delays

Showings and home inspections

Smoke inspections and water readings

Working with Buyers

Limited showings times

Unpredictable rates and changing qualifications for loans

Potential for job loss or furlough prior to closing due to economic factors

Factors for Both Buyer and Sellers

Apprehension in market effects due to Covid 19

Apprehension in allowing or going on showings due to Covid 19

Evolving process with closings

Innovations in Real Estate

Virtual Showings

Facetime, Marco-Polo app, Zoom Open House, YouTube

Neighborhood Tours

3D Walkthroughs

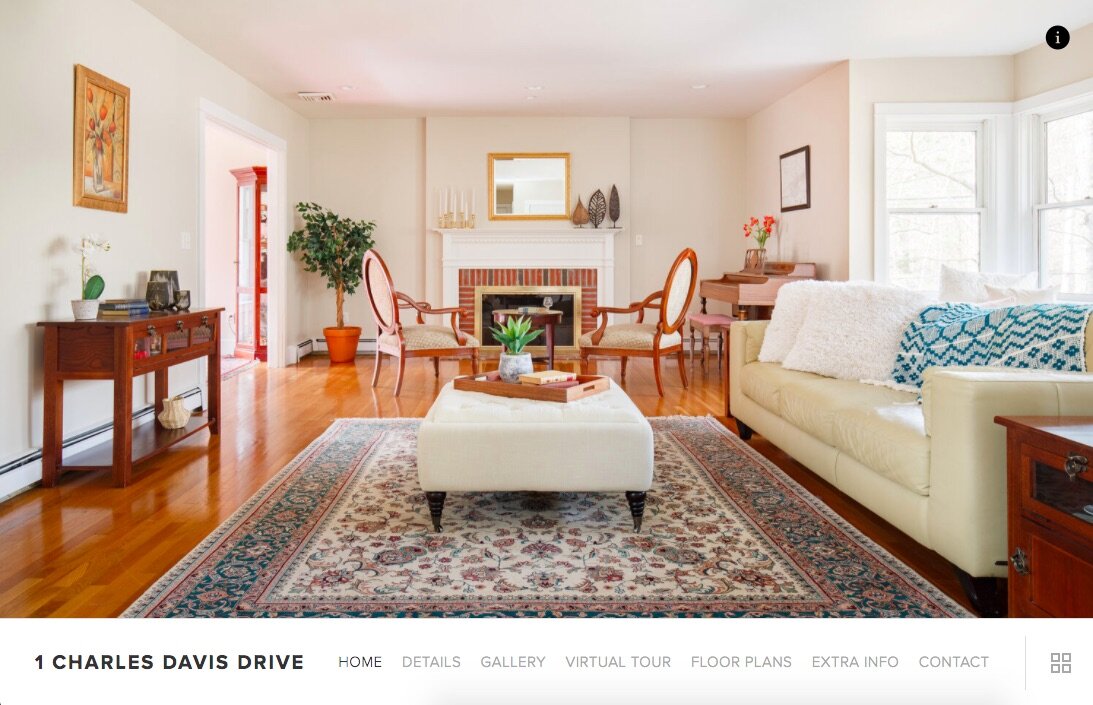

Property Websites

Virtual Staging

My Crystal Ball Predictions

Based on statistics

Predominantly under $600k markets have motivated buyers and sellers - Example Salem

DOM similar to last year

Agents are resisting price changes compared to last year

Mid Range markets with predominantly single familys $500k-$1M have motivated buyers but apprehensive sellers - Example Beverly, Marblehead

DOM have actually gone down compared to last year at this time

Agents are quicker to do price changes compared to last year

Predominantly Luxury markets have not seen a big change - Example Manchester

DOM similar to last year

Second home market heating up

My Opinion of Trend Changes

Shift to Suburbanization

30% of entertainment and restaurant establishments to go out of business, decreasing the desirability where those are the driving factors - Example: South End, Davis Square, Seaport District

Confined small space city living during quarantine motivating suburban move

Home office and yard space jumped up on priority lists

City companies will be dropping their expensive commercial leases and allowing for more WFH making commuting distance not as important

FAQ’s

+ I’m thinking about buying at some point, where do I start?

Tell Blake and he will find an agent who is experienced in your area. The agent will be your one resource for education, introduction to vendors, help define your search location and set up showings.

+ How do I go about finding a lender?

Your agent should be your best resource for finding a lender to work with. Radio, paper, tv and internet pop up ads are exactly that. They are advertising and a lot of times are twisting and presenting options that might not be available or might be outdated. Working with vender your agent already has a relationship will make it easier on you. They will know how each other work in an efficient manner, it’s an extra layer of security and assurance you are getting good service and it takes the pressure off of vetting handfuls of shady lenders who may or may not be telling the truth.

+ What does a Real Estate agent do?

A real estate agents has many hats but in a nut shell they; help buyers and sellers navigate preperation, showings, negotiations, transaction management create an environments of transparency and consultation. A trusted advisor.

+ How does Zillow work?

Zillow is the most successful aggrigator. They have developed a website that agrigates all listing data and presents it in a user friendly mannor to the public. They are not a brokerage and do not sell property. The way they make money is to then sell leads (buyers/sellers) to real estate agents. When you search on Zillow and see a list of agents next to the property, typially the listing agent is the first one and then there is a list of 4-5 other agents below. The 4-5 other agents are paying monthly to get a certain portion of the impessions in that zip code that they can then try to convert into clients.

+ How does Redfin work?

Redfin is defined in the industry as a discount brokerage. They have set up their model in a way that they have salary employees who work as a team with buyers and sellers at a discounted commission. Instead of working with one agent when working with Redfin you get assigned a manager. That manager then will send the field agent on duty when you want to see a property. When you want to make an offer you will let them know and they will draft the offer and present it most times without actually seeing the proeprty themselves. Once the offer is accepted they will then pass it along to the transaction manager. This model is a model instivised showings and new clients, not the quality of service. Since they do not get a commission and they make bonuses on the amount of showings and offers presented, clients tend to get very little education, guidance or support. They will get a portion of the commission back to go towards closing costs. My argument with Redfin is that while you might get a few grand back at closing, over and over again I have seen Redfin agents instuct their clients to overpay for property. An example on one of my listings was that we got 3 offers. The Redfin offer ended up being $40k higher then the other offers. That client ended up saving $3k but paid $30k more then they needed to and got bare bones service. Is it worth the gamble?

+ How do commissions work?

Part of the sellers closing cost is the commission. The commission percentage is determined when the listing agent and seller decide to work together. There is not set commission percentage and it is illegal to say such. That said areas tend to have commonly seen commission and brokerages can set guidelines for minimums they will allow. In MA 5% is the most widely used and what I charge. That 5% is then cut up multiple different ways. Typically the buyer brokerage and listing brokerage will split that 50/50. That 50% or in the example we are using 2.5% will then be split between the agent and the brokerage. The agent split % is negotiated as part of the contract with their brokerage. This split can span from 50% to 95% of that example 2.5% and is variable on experinece, what the brokerage provides and the volume the agent produces. Another factor to what the agent ends up getting is if the client was a referral from another agent or referal service or it was a collaboration with anothe agent. This could reslut in a 25-50% split with the other agent or referal service. The agents payment is also paid without taxes taken out so the agent then has to pay a portion to the IRS.

5% - full commission

2.5% - buyer brokerage or seller brokerage portion of commission

1.25 - 2.375% - agent portion after brokerage split

Example: $1M property

$50,000 - full commission

$25,000 - brokerage commission

$12,500 - $23,750 - agent commission net before taxes

$8,750 - $16,625 - agent gross after taxes using 30% tax rate

+ How much money do I need to purchase?

There are two parts to the cost of a purchase; Downpayment and Closing Costs.

Downpayment: The lowest percent down lies with the VA loan for veterens. If you are not a veteran the only other option for 0% down is the USDA loan. USDA loans are typicaly in very rural areas and have income restrictions. For the majority of Americans FHA is the lowest federally backed loan program which is 3.5% down + closing costs. That all said, Im sure you have heard of 20% down as the standard. This is said because below 20% down you will be required to get mortgage insurance and may have to pay a premium as it is thought of as a riskier loan.

Closing Costs: This consists for buyers mostly of lender and attorney related closts. Certain fees are based on when the proeprty closes such as refund of taxes pre-paid by seller, refund of condo fees pre-paid by seller and oil adjustments.

Example: $700k property, 20% down, $7200 Annual Taxes, $1080/year insurance premium

- Settlement Fee: $750

- Credit Report: $79

- Flood Certification Fee: $10

- FNMA LQI: $28.50

- Origination fee: $995

- Recording Fees: $365

- Tax Service Fee: $89

- Taxes Reserves: $1,800

- Owners Title Insurance: $1,470

- Lender's Title Insurance: $1,300

- Appraisal Fee: $430

- Hazard Insurance Premium: $1,080

- Hazard Insurance Reserves: $270

- Oil Adjustment: +$$$

- Tax Adjustment: +$$$

- Condo Fee Adjustment: +$$$

TOTAL: $8,666.50

For sellers the closing cost mostly consists of commissions.

Example: $700k property

- Commission: $35,000

- Tax Stamps: $3,192

- Smoke Certificate: $50

- Settlement Fee: $750

- Final Water/Sewer: $$$

- Oil Adjustment: -$$$

- Tax Adjustment: -$$$

- Condo Fee Adjustment: -$$$

TOTAL: $38,992

Who can you refer to me?

+ Primary Referral: Anyone in Eastern MA!!

I will work with them or will collaborate with a colleague to help them. I have direct colleagues from the Cape and Island all the

+ Secondary Referral: Anyone you know in the USA looking to buy or sell.

I will find an agent that is experienced in that area. There are a couple reasons for this: one the agent they work with now have accountability from me, two I will get a 25% referral of their commission once the sale closes and three you will look great for having a contact that could refer them a great agent!

CHEERS

& THANK YOU!!!